August 2024 showed a slight dip in home sales compared to the same period last year. With 4,975 homes sold, down 5.3% year-over-year, the market remains well-supplied. Average home prices saw minor decreases, with detached homes selling for $1,414,070, a 0.3% drop from August 2023.

Price Dynamics

- Detached homes: $1,414,070, down 0.3%

- Semi-detached homes: $1,026,435, down 3.9%

- Townhomes: $891,925, down 4.6%

- Condos: $674,706, down 4.5%

These slight declines reflect seasonal trends and increased inventory, particularly in townhomes and condos, which have become more attractive for buyers seeking affordability. The condo market, in particular, presents a great opportunity for first-time buyers due to the combination of lower prices and easing interest rates.

Sales Trends

Home sales across all property types were down compared to last year, with condos seeing the sharpest decline:

- Detached homes: 2,218 sales, down 1%

- Semi-detached homes: 427 sales, down 3.4%

- Townhomes: 872 sales, down 6.1%

- Condos: 1,417 sales, down 11.4%

While overall sales have softened, the gradual reduction in borrowing costs is expected to lead to an increase in first-time buyers, especially within the more affordable condo segment.

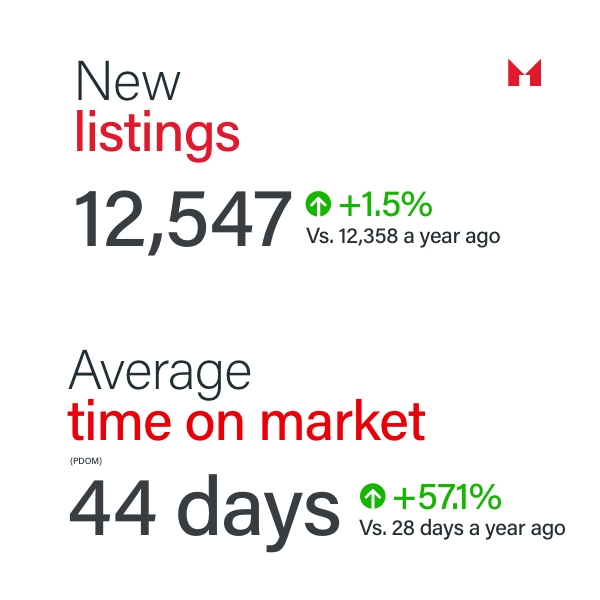

Inventory and Time on Market

New listings rose slightly by 1.5%, totaling 12,547 for the month, compared to 12,358 in August 2023. This added inventory is helping stabilize prices but has also lengthened the average time on market to 44 days, up 57.1% from last year.

Impact of Recent Interest Rate Cuts

The Bank of Canada’s recent rate cut, announced in early September, is expected to make a significant difference for buyers, particularly those using variable-rate mortgages. Lower mortgage rates will provide relief, encouraging more buyers to enter the market. This is likely to benefit first-time buyers and investors, especially as interest rates are projected to trend lower throughout the remainder of the year. Easing mortgage payments and a more accessible lending environment could drive increased activity in the coming months.

Outlook

The GTA real estate market is expected to stabilize in the near term as buyers take advantage of falling borrowing costs. While inventory remains elevated, demand is forecasted to pick up in 2025, especially as the effects of lower interest rates become more pronounced. However, price growth is likely to stay moderate until the supply of new listings begins to taper off.

Team McDadi Can Help You Navigate This Market

Whether you’re a buyer or seller, Team McDadi is here to guide you through these evolving market conditions. Our expert team, backed by relationships with top lawyers and mortgage professionals, ensures that your real estate journey is as smooth as possible. With a deep understanding of current trends and market shifts, Team McDadi is committed to helping you make informed decisions with confidence.

The market is always changing, and we’re here to ensure you’re prepared. Whether you’re taking your first step toward homeownership or selling a property, Team McDadi stays ahead of trends to help you navigate with ease: