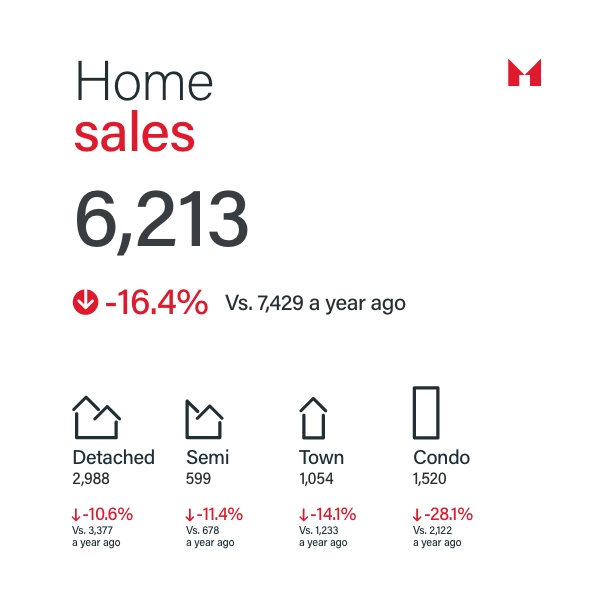

June 2024 saw a significant decline in home sales in the Greater Toronto Area (GTA). With 6,213 transactions, this marked a 16.4% drop compared to June 2023. Despite the recent Bank of Canada rate cut, buyers remain cautious, keeping their purchase decisions on hold. The market remains well-supplied, leading to a slight dip in average selling prices.

Price Dynamics and Market Movements

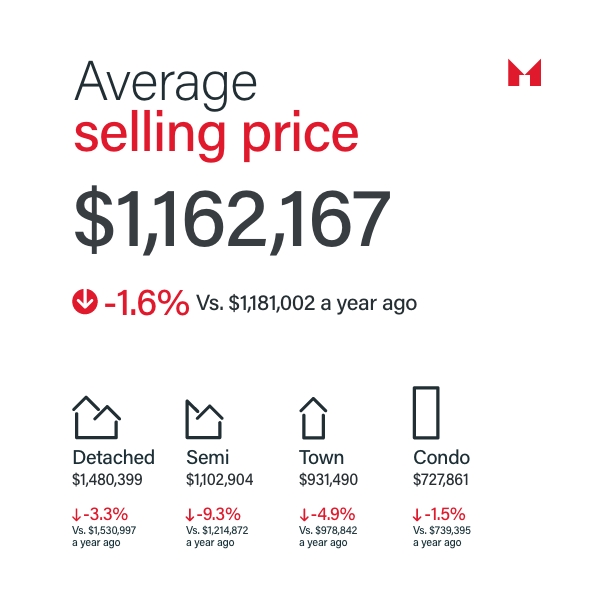

The average selling price in June 2024 was $1,162,167, down 1.6% from $1,181,002 in June 2023. Here’s a detailed breakdown:

- Detached Homes: $1,480,399, down 3.3% from $1,530,997 in June 2023.

- Semi-detached Homes: $1,102,904, down 9.3% from $1,214,872 in June 2023.

- Townhomes: $931,490, down 4.9% from $978,842 in June 2023.

- Condo Units: $727,861, down 1.5% from $739,395 in June 2023.

Despite these declines, there was a slight month-over-month increase in the average selling price compared to May 2024, indicating some resilience in the market.

Sales Trends and Listings

Sales across all housing types were down year-over-year, with notable declines in semi-detached homes and condos. Here are the specific numbers:

- Detached Homes: 2,988 sales, down 10.6% from 3,377 in June 2023.

- Semi-detached Homes: 599 sales, down 11.4% from 678 in June 2023.

- Townhomes: 1,054 sales, down 14.1% from 1,233 in June 2023.

- Condo Units: 1,520 sales, down 28.1% from 2,122 in June 2023.

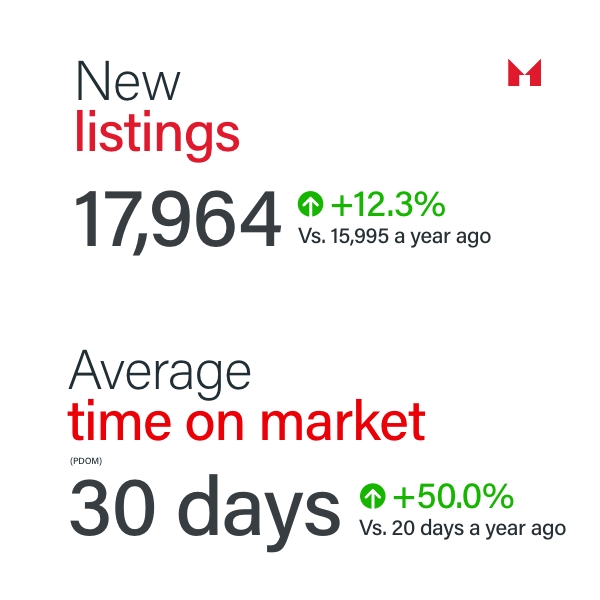

However, new listings increased by 12.3%, totaling 17,964, providing more options for buyers but contributing to lower prices due to increased supply.

Time on Market Insights

The average time on market (PDOM) in June 2024 was 30 days, up from 20 days a year ago, marking a 50% increase. This longer selling period indicates a more cautious market where buyers have more negotiating power.

Impact of Interest Rate Cut

The Bank of Canada’s interest rate cut in early June has not yet significantly impacted buyer activity. While it provides some relief, TRREB’s polling suggests multiple rate cuts are needed to stimulate a noticeable increase in home sales. Buyers appear to be waiting for cumulative rate cuts of 100 basis points or more before moving off the sidelines.

Long-Term Market Drivers

Despite the current dip, strong population growth continues to drive long-term demand for both ownership and rental housing. Ontario’s target of 1.5 million new homes by 2031 requires coordinated efforts from all government levels to reduce barriers and support housing construction. This includes removing red tape, avoiding financial barriers to home construction, and minimizing housing taxes and development charges.

Future Market Predictions

As borrowing costs potentially decrease, demand is expected to rise, leading to renewed upward pressure on prices. TRREB forecasts a more competitive market environment, driven by both increased listings and buyer activity. The alignment of government policies with housing needs, including infrastructure development like the Eglinton Crosstown LRT, will play a crucial role in supporting this growth and ensuring long-term affordability.

How Team McDadi Can Help

Navigating this complex market requires expert guidance. Team McDadi partners with top lawyers and mortgage professionals to help you buy or sell your home with confidence. Our established relationships and deep market knowledge ensure a smooth transaction, whether you’re a first-time buyer or a seasoned investor. As market conditions evolve, rely on our team to provide up-to-date insights and support every step of the way.

Embark on Your Real Estate Journey:

- Ready to buy? Explore our current listings

- Planning to sell? Get your complimentary home evaluation here

With Team McDadi, you’re backed by a partnership that ensures your real estate journey is as rewarding as possible. We stay ahead of the latest market trends, helping you make informed decisions and achieve your real estate goals with confidence.